A New Kind of Wealth: Gen Z Is Rewriting the Rules

For years, economic success followed a familiar pattern: make steadily, save strongly, get a home, and plan for retirement. But Gen Z is coming close to money with a fresh point of view. As opposed to focusing exclusively on lasting accumulation, this generation is focusing on balance, health, and deliberate living.

This shift has actually generated the idea of soft conserving. It's not regarding deserting economic goals however redefining them. Gen Z wishes to live well today while still bearing in mind tomorrow. In a globe that really feels increasingly uncertain, they are choosing fulfillment now instead of delaying joy for years.

What Soft Saving Really Means

Soft conserving is an attitude that values psychological wellness together with financial responsibility. It reflects an expanding idea that cash must support a life that feels meaningful in the here and now, not simply in the distant future. Rather than putting every added dollar into savings accounts or retired life funds, lots of young adults are choosing to invest in experience, self-care, and personal development.

The surge of this ideology was sped up by the global occasions of recent years. The pandemic, financial instability, and altering work characteristics prompted several to reevaluate what really matters. Confronted with changability, Gen Z began to accept the idea that life must be appreciated in the process, not just after getting to a savings objective.

Psychological Awareness in Financial Decision-Making

Gen Z is approaching cash with emotional recognition. They want their monetary selections to line up with their worths, mental health and wellness, and way of living goals. As opposed to obsessing over standard standards of wealth, they are looking for objective in how they make, invest, and conserve.

This might appear like costs on psychological health resources, funding innovative side projects, or focusing on flexible living plans. These options are not spontaneous. Rather, they mirror a conscious effort to craft a life that supports happiness and stability in a manner that feels authentic.

Minimalism, Experiences, and the Joy of Enough

Lots of youngsters are averting from consumerism for minimalism. For them, success is not concerning possessing more but about having enough. This connections straight right into soft financial savings. As opposed to gauging wide range by product properties, they are concentrating on what brings authentic happiness.

Experiences such as traveling, shows, and time with good friends are taking precedence over deluxe products. The shift reflects a much deeper need to live completely instead of build up endlessly. They still conserve, however they do it with intent and balance. Conserving becomes part of the plan, not the entire emphasis.

Digital Tools and Financial Empowerment

Innovation has played a significant function in shaping just how Gen Z engages with money. From budgeting applications to financial investment platforms, electronic tools make it easier than ever before to stay educated and take control of personal funds.

Social media site and online areas also affect how economic priorities are established. Seeing others build adaptable, passion-driven professions has actually encouraged several to seek comparable way of livings. The availability of economic info has actually empowered this generation to produce approaches that work for them as opposed to following a standard course.

This increased control and understanding are leading several to seek out trusted experts. As a result, there has been a growing rate of interest in services like wealth advisors in Tampa that understand both the technological side of finance and the emotional inspirations behind each decision.

Protection Through Flexibility

For past generations, economic stability often indicated sticking to one task, buying a home, and complying with a fixed plan. Today, security is being redefined. Gen Z sees flexibility as check out this site a type of security. They value the capability to adjust, pivot, and explore multiple earnings streams.

This redefinition extends to exactly how they look for economic guidance. Lots of want approaches that think about job changes, gig work, innovative goals, and altering family members characteristics. As opposed to cookie-cutter guidance, they want individualized assistance that fits a vibrant way of living.

Specialists who provide insight into both planning and adaptability are becoming increasingly important. Services like financial planning in Tampa are progressing to consist of not only conventional financial investment suggestions but likewise methods for keeping financial health throughout shifts.

Straightening Priorities for a Balanced Life

The soft cost savings fad highlights a vital change. Gen Z isn't overlooking the future, but they're choosing to live in a manner in which doesn't give up happiness today. They are looking for a center path where temporary enjoyment and long-lasting stability exist side-by-side.

They are still purchasing retired life, repaying debt, and building cost savings. Nonetheless, they are also making room for pastimes, travel, downtime, and remainder. Their variation of success is more comprehensive. It's not practically net worth however concerning living a life that really feels abundant in every feeling of words.

This perspective is urging a wave of adjustment in the economic solutions sector. Advisors that concentrate solely on numbers are being replaced by those that recognize that worths, identity, and emotion play a main function in monetary decisions. It's why more people are turning to asset management in Tampa that takes an alternative, lifestyle-based strategy to wide range.

The new criterion for financial health blends method with empathy. It listens to what individuals actually want out of life and builds a strategy that supports that vision.

Adhere to the blog for more insights that show real life, modern-day money practices, and just how to grow in manner ins which really feel both useful and individual. There's even more to explore, and this is only the start.

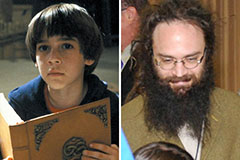

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Scott Baio Then & Now!

Scott Baio Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now!